Analysis of Recent Stainless Steel Price Trends: A Dual Game Between Raw Material Costs and Macroeconomic Supply and Demand

As an important industrial metal material, the price fluctuations of stainless steel not only directly reflect the market supply and demand relationship, but also represent a complex interplay of factors such as the costs of upstream core raw materials like nickel, chromium, and iron, the global macroeconomic environment, and changes in downstream end-user demand. Recently, stainless steel prices have exhibited significant characteristics of consolidation and cost support, and the underlying driving factors warrant in-depth analysis.

I. Core Raw Material Costs: Key Drivers of Price Fluctuations

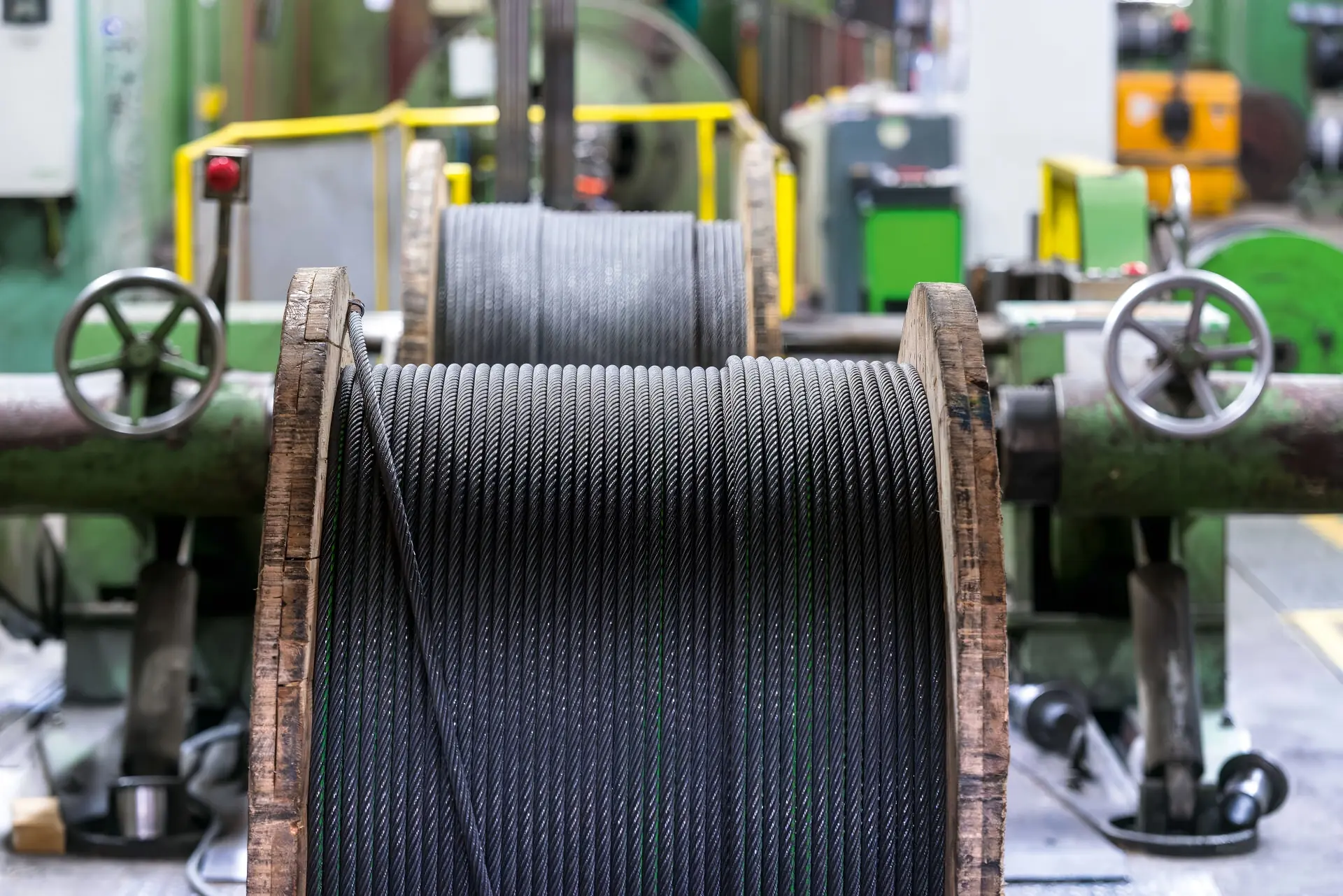

Stainless steel prices are far more volatile than those of ordinary steel, primarily due to the extremely high proportion of **nickel and chromium** in their cost structure. Nickel, in particular, accounts for 60%-70% of the cost of 300-series stainless steel (such as 304).

1. Nickel Price Rebound and Cost Support

1.1 Recent Developments:

After a significant correction, London Metal Exchange (LME) nickel prices have recently shown a clear stabilization and even rebound. This is mainly attributed to improved macroeconomic sentiment (such as a weaker US dollar and easing geopolitical risks) and a correction in some market expectations of oversupply.

1.2 Impact Transmission:

The rebound in nickel prices has directly provided strong support for stainless steel production costs. In particular, although the price of Indonesian high-nickel pig iron (NPI) is fluctuating at a low level, the overall rebound in nickel prices has made it difficult for stainless steel mills' immediate production costs to fall significantly. This cost-side pressure is the primary reason for the recent bottoming out of stainless steel spot and futures prices.

2. Supply and Demand Balance of Ferrochrome and Scrap Stainless Steel

2.1 Ferrochrome:

As another major alloying element in stainless steel, ferrochrome prices are relatively stable, but its cost is affected by power supply and mine operations in major producing regions such as South Africa.

2.2 Scrap Stainless Steel:

Fluctuations in scrap steel prices reflect the raw material procurement flexibility of stainless steel companies. With the depreciation of the New Taiwan Dollar or Renminbi, some steel mills face upward pressure on imported raw material procurement costs, further pushing up overall costs.

II. Market Supply and Demand Structure and Inventory Pressure Analysis

1. Supply Side: Coexistence of Capacity Release and Environmental Constraints

1.1 Indonesian Capacity Impact:

Indonesia, the world's largest producer of nickel pig iron and stainless steel, has seen its low-cost nickel pig iron production capacity continue to be released, creating a structural impact on the global nickel resource supply. This is the main reason for the sharp decline in nickel prices in the previous period, and has also indirectly suppressed the upward potential of global stainless steel prices.

1.2 Domestic Operating Rate:

Squeezed by both weak demand and high costs, the operating rate of domestic stainless steel producers fluctuates significantly. Although there are some capacity restrictions (such as Indonesia's suspension of approvals for new nickel-iron capacity), the overall supply pressure is unlikely to be completely eliminated in the short term.

2. Demand Side: Traditional Off-Season and Policy Expectations

2.1 Weak End-User Demand:

The stainless steel market is currently in its traditional off-season, with weak order growth momentum in downstream manufacturing sectors (such as home appliances and machinery), and slow inventory digestion.

2.2 Macroeconomic Policy Expectations:

The market is closely watching for marginal improvements in infrastructure investment and real estate policies. Once future infrastructure projects and year-end restocking demand are gradually released, it will help boost market confidence and promote spot inventory reduction. In addition, European customers are stocking up in advance to cope with EU quota policies, providing temporary support for domestic export orders.

III. Futures Market Performance and Price Trend Analysis The price trend of the Shanghai Futures Exchange (SHFE) stainless steel main contract is generally regarded as a "barometer" of market sentiment.

3.1 Volatile Pattern:

Recently, stainless steel futures prices have exhibited a range-bound trading pattern, pressured by both cost support and demand. Trading volume and open interest have fluctuated frequently with market sentiment.

3.2 Basis Performance:

The basis between futures and spot prices is a key indicator of the tightness of market supply and demand. The recent spot basis premium (spot price higher than futures price) indicates a relatively cautious market outlook on future prices, but spot sales prices are resilient due to cost support.

Overall Assessment and Outlook:

Short-Term (Recent):

Stainless steel prices will continue to fluctuate around the raw material cost line. Fluctuations in LME nickel prices and the speed of domestic inventory digestion will be the main determinants of short-term prices.

Medium-Term (Next Months):

With improving macroeconomic signals (such as expectations of a Fed rate cut and easing geopolitical tensions) and a seasonal recovery in domestic end-user demand, the market is expected to experience a **mini-boom** driven by restocking demand and cost increases after bottoming out. In particular, if leading stainless steel companies can successfully raise their monthly prices, it will have a positive impact on market sentiment.